Tough Tax Questions? Ask a Tax Pro by becoming a VIP Member! Check out all the included perks.

NEW TO TAXES? SELF-STUDY COURSE AVAILABLE IN ENGLISH, SPANISH, OR BILINGUAL

TAX PREPARATION COURSE | BEST SELLER

New to Taxes

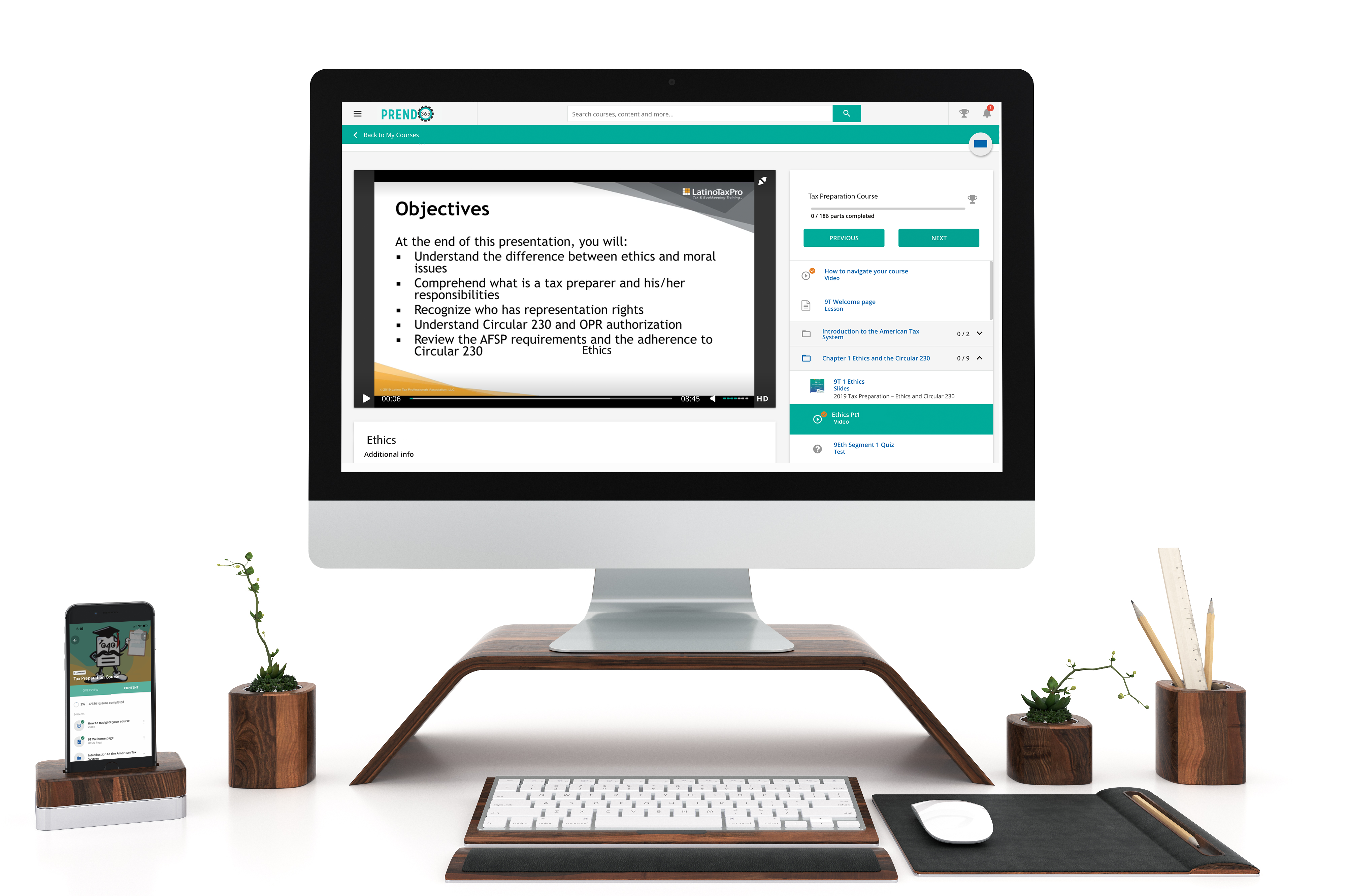

Tax Preparation Course

Our Tax Preparation Course is designed to give you the knowledge needed to fulfill IRS requirements and give you a basic understanding of tax law and practice to ensure you serve your clients with the highest quality. This study material has been organized to give line-by-line instructions for Form 1040.

CLICK A LANGUAGE TO VIEW DETAILS

English | Bilingual | Spanish

California CTEC 60 Hour

This course meets the 60 hour Qualifying Education requirement (45 hours of Federal Tax Law, which includes the required 2 hours of Ethics and 15 hours of California Tax Law) imposed by the state of California to become a California Registered Tax Preparer (CRTP).

CLICK A LANGUAGE TO VIEW DETAILS

English | Bilingual | Spanish

Renewing Tax Pros

Increase your revenue during the training season by offering tax courses with IRS approved credits on your own website!

Click Here to Learn MoreENGLISH & SPANISH TAX TRAINING

CO-BRANDED WEBSITE

Live Events

Corporations and Partnerships

Are you ready to take the next step in your career? Join our Level I and Level II Corporations & Partnerships course to learn how to prepare business tax returns. Level I will provide line-by-line guidance for forms 1120, 1120s, and 1065. Level II will use the same example from Level I to expand on PPP loan forgiveness, explaining the different type of stockholders for each entity, what complications may arise based on the stockholder’s percentage rate, who holds the majority to make the final decisions, net operating loss, and more!

Visit us in Salinas, CA for these upcoming events!

Anyone is welcome to join our open house or wine tour to meet our team and network with other tax professionals.

New California Tax Preparers

Do you learn better from a live instructor but struggle to find a local class? We've got you covered with our live webinar! This beginner webinar is designed to guide you through learning how to prepare form 1040. If you're from California, you are required to take the 60 Hour Course.

THIS IS A 10 WEEK WEBINAR COURSES, MEETING TWICE A WEEK.

Renewing California Tax Preparers

The CTEC 20 Hour Continuing Education renewal course fulfills the 20-hour CTEC requirement for CRTPs who have already completed 60 hours of Qualifying Education.

Annual Filing Season Program

This 3-day live webinar will give the attendee 10 hours of tax law, 2 hours of Ethics. This includes the Annual Federal Tax Refresher exam to complete by the deadline to earn 6 hours of AFTR

Check out what customers are saying about Latino Tax Pro...

About Latino Tax Pro

Online and live tax and accounting training

We are a bilingual team with over 37 years of experience in the tax industry serving the multi-cultural taxpayers of America. All of our education is based out of real-life experiences that you will encounter as a Tax Professional. Our courses are IRS, NASBA, and CTEC approved. Reach out to our California based call center if you have any questions!

Call or Text us at (866) 936-2587 or email us at info@latinotaxpro.com