CTEC Registered Tax Preparer (CRTP)

California New or Renewing Preparers click a button below to get started

Questions? Fill out the form below to be contacted by our team.

Deadline to RENEW with CTEC is October 31

At the end of October, if you haven't renewed your registration you must act fast to avoid re-registering as a new preparer. Between November 1 and January 15, you can still renew for $88 - an extra $55 on top of the regular price!

California law requires anyone who prepares tax returns for a fee within the State of California and is not an exempt preparer to register as a tax preparer with the California Tax Education Council (CTEC).

NEW CTEC Registered Tax Preparers (CRTP) must...

• Complete 60-hours (45 hours federal and 15 hours state) of qualifying tax education from a CTEC Approved Provider

• Pass a background check and live scan

• Obtain a PTIN (Preparer Tax Identification Number) from the IRS

• Purchase a $5,000 tax preparer bond

• Register with CTEC within 18 months from the completion date on the certificate of completion

• Pay a registration fee with CTEC of $33

To RENEW your registration all CRTPs must...

• Complete 20-hours (10 hours federal tax law, 3 hours federal tax update, 2 hours of Ethics and 5 hours for State) of continuing tax education each year

• Maintain a valid PTIN (Preparer Tax Identification Number) from the IRS

• Maintain a $5,000 tax preparer bond

• Renew the registration by October 31st of each year*

• Renewal Registration with CTEC $33

* If the student does not complete their continuing education by the late renewal of January 15 of the following year, they will need to retake the 60-hour course, get a background check, and be fingerprinted.

Benefits of a CRTP

IRS Tax Preparer Directory

Be included in the public directory of tax return preparers on the IRS website.

Refreshed for Tax Season

You will learn the latest updates every year you renew with CTEC

Limited Representation

You will be able to represent clients during an examination of a return that you prepared if you sign the Circular 230 form.

New California Tax Preparers

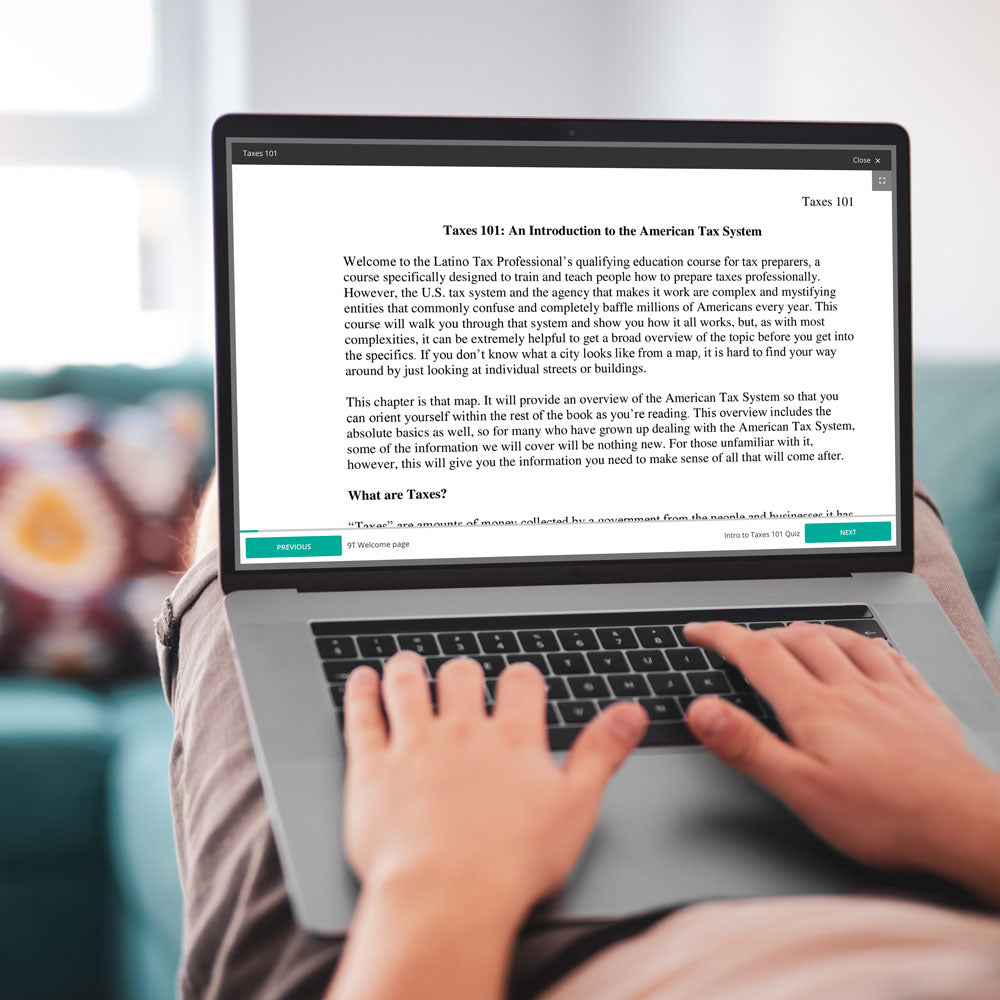

This course meets the 60-hour Qualifying Education requirement (45 hours of Federal Tax Law, which includes the required 2 hours of Ethics and 15 hours of California Tax Law) imposed by the state of California to become a California Registered Tax Preparer (CRTP).

Live Webinars & In-Person

Renewing California Tax Preparers

The CTEC 20 Hour Continuing Education renewal course fulfills the 20-hour CTEC requirement for CRTPs who have already completed 60 hours of Qualifying Education. California residents must provide an active PTIN, maintain a $5,000 tax preparer insurance bond, and complete 20 hours of CE by October 31st each year to renew their registration with CTEC.

Live Webinars

Other CTEC Approved Courses

Don't need the full 60 or 20 hours for CTEC? Here are two more options.

The California 5 hour tax law course is for tax preparers that ONLY need to complete their required 5 hours of California tax law.

The California 15 hour qualifying education is for those who have prepared returns from another state and have moved to California and will prepare California tax returns.